Finding the Best Yield Outside of Ethereum

Market Meditations | October 13, 2021

💠 The Problem

DeFi has allowed participants to earn huge yields on their assets; however this year, DeFi on Ethereum has become increasingly expensive to use.

For many users, it is no longer profitable to use the ecosystem.

💠 The Solution

Fortunately this has driven the adoption of other layer 1 blockchains where fees are cheaper and DeFi is more accessible.

These alternative layer 1s often have large incentives to attract new capital and as such, not only are fees cheaper, but yields higher. The opportunity for profit is therefore huge.

We can use Nansen to dive into exactly where capital is flowing – so that you are able to take advantage of these high yielding opportunities.

💠 Step 1: Investigate USDC Flows over 7 days

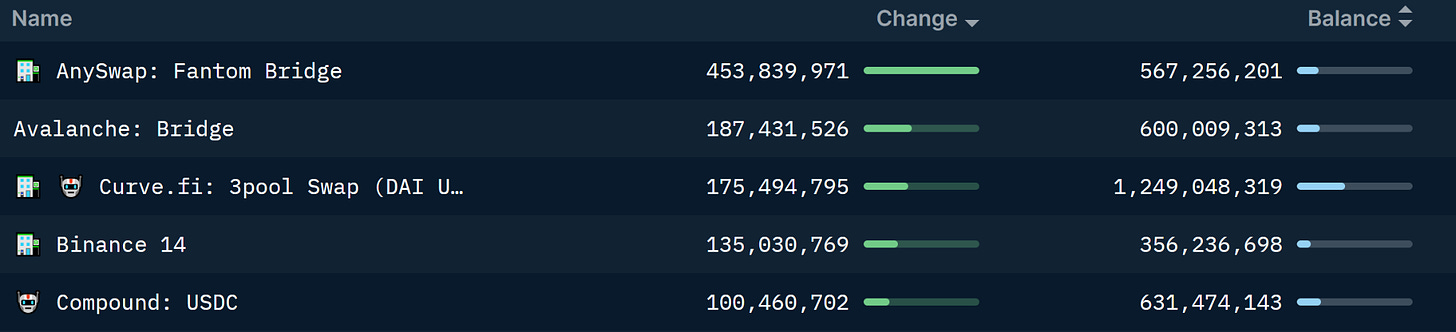

Source: Nansen.ai: Balance Changes Over 7 Days for USDC

- This table shows that the biggest net recipient of USDC over the last week was AnySwap: Fantom Bridge – the multichain bridge that allows assets to flow into Layer 1 ecosystem, Fantom.

- The second largest is the bridge to Avalanche – highlighting the adoption of Layer 1 chains outside of Ethereum

If we look at WBTC and WETH, these mirror the trend, with Fantom being by far the largest recipient of those assets over the past week.

What does this tell us?

✅ It tells us that Fantom is going through a period of huge growth with Ethereum participants bridging large amounts of assets over to the ecosystem – likely in search of yield.

💠 Step 2: Dive Deeper Into An Individual Protocol

So we know that Fantom is gaining a huge amount of traction, however Nansen also allows us to focus our search on exactly what protocols capital is flowing into:

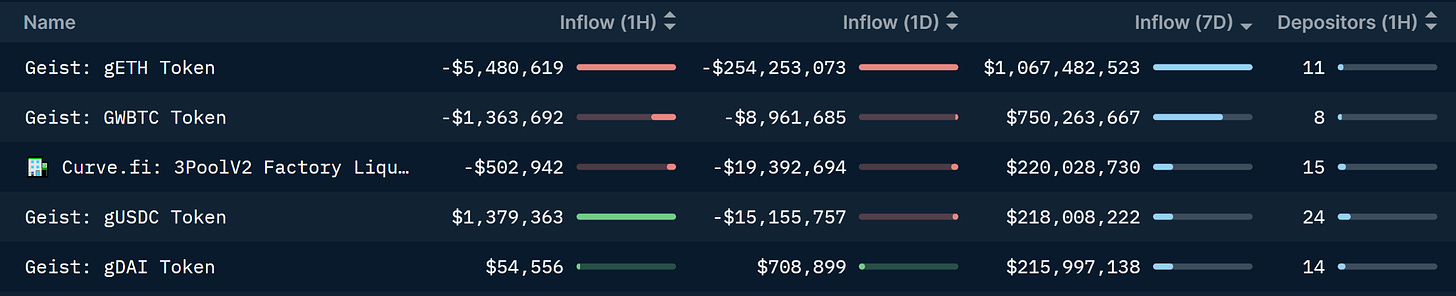

Source: Nansen.ai: Smart Contracts with Most Inflow (by $) over the past 7 days

- Geist is clearly the largest recipient of assets in the last 7 days, representing 4 out of the top 5 hottest contracts.

- Geist is a new lending protocol which since launch has accrued a total value locked of $2.6bn (data source: DeFi Llama).

- Even though yields have now normalized since launch, causing some outflows, it remains over 50% of Fantom’s entire ecosystem in terms of TVL.

- Using Nansen we could have seen these flows in real time and capitalised on this huge opportunity.

💠 Concluding Remarks

High yields are always present in DeFi, however they can be difficult to find.

Using Nansen we can dive into which layer 1 blockchains capital is flowing into and then drill down into exactly which protocols are the most active.